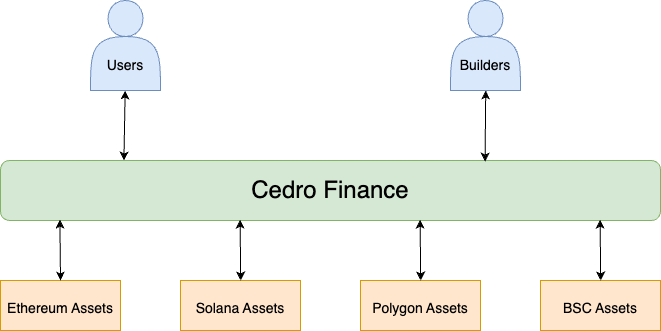

🎆Cedro as an Ecosystem

One of the major goals of Cedro Finance is to act as a cross-chain Liquidity Layer over time. Builders will be able to use Cedro's Liquidity and codebase to build their applications without having to worry about liquidity on their platform. A few out of the many applications that can be built using Cedro as the infrastructure are:

Overcollateralized Decentralized Omnichain Stablecoins (ex. DAI for cross-chain)

Peer-to-Peer Cross-chain Lending & Borrowing Platforms (ex. Morpho for cross-chain)

Cross-chain DEXs (ex. Stargate)

Omnichain Yield Aggregators (ex. Yearn for cross-chain)

Cross-chain Perpetual Trading Platforms

Credit line for fiat Platforms

And many more...

Some of these applications will be built in-house and, at the same time, builders will be incentivized through various programs to help build the Cedro Ecosystem.

Last updated