🦄CULT (Cedro Unified Liquidity Token)

In the world of multiple isolated blockchains, projects that are looking to expand have no other option than to issue their token separately across multiple isolated chains. For example, UNI is deployed on multiple chains, which means it’ll have a liquidity pool on each chain with no interconnection. This fractures the already fractured liquidity and reduces capital efficiency. This problem is tackled by Cedro Unified Liquidity Token. It is a novel feature developed by Cedro.

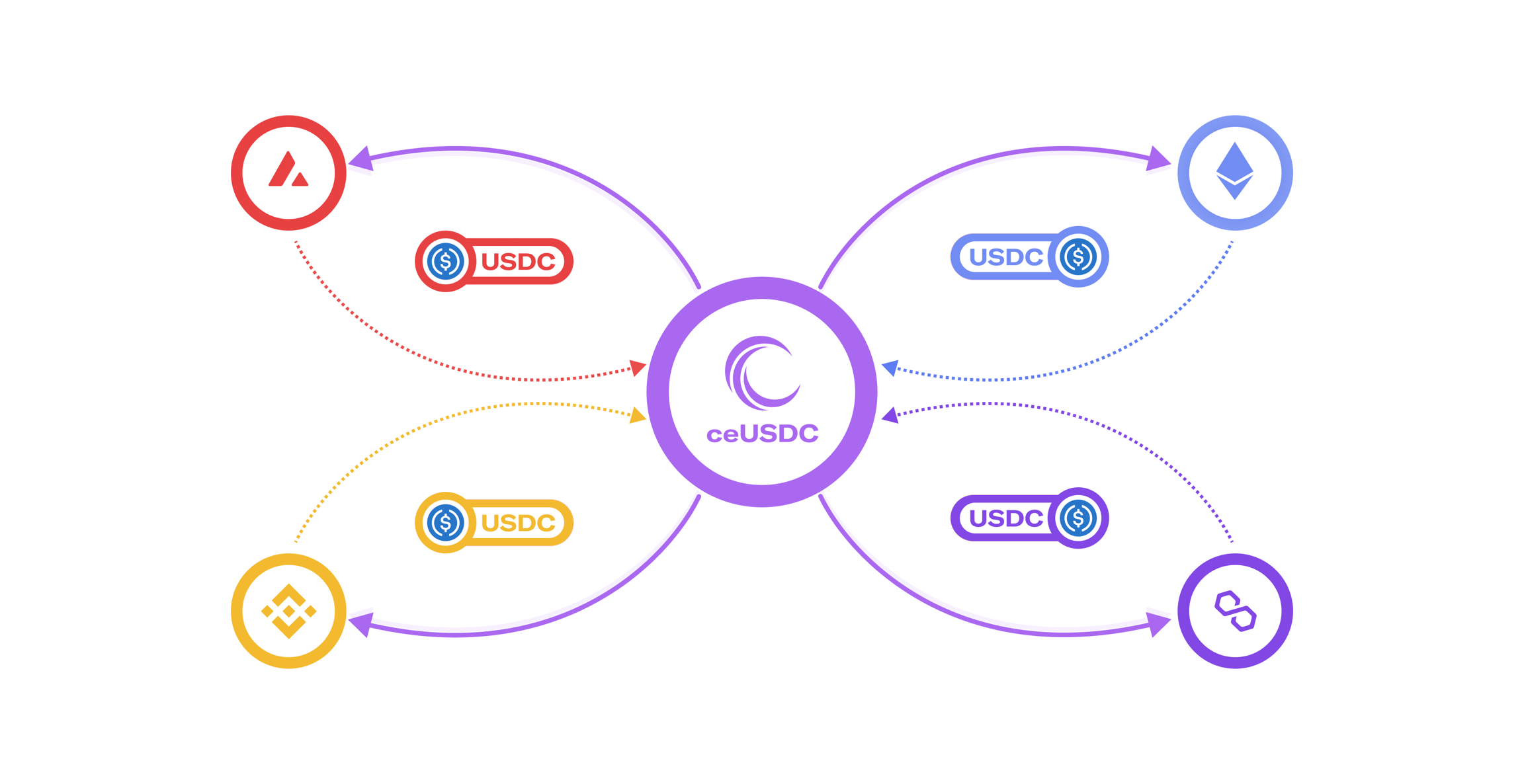

CULT lets users deposit multi-chain assets (ex. USDT, UNI, etc.) from different chains and add them to a unified liquidity pool. For example, when a lender deposits 100 USDC in Ethereum and 200 USDC in Solana, they’ll receive 300 ceUSDC on the Root chain and receive interest on them. Because of the unified liquidity pool, the capital will be concentrated in a single pool and the efficiency will be maximal. The interest rate will be the same across all the chains for multi-chain assets. On top of that, users can borrow the asset on any supported chain which makes multi-chain assets truly chain agnostic. This means we are merging the Liquidity Pools at an asset level and sending capital efficiency to the moon 🚀 .

The Liquidity Pools aren't literally merged though. We are virtually able to merge the pools since all the global state variables are stored in the Root. For the merging, we introduce two additional parameters: Global Liquidity Factor (GLF) and Asset Correlation Factor (ACF).

Global Liquidity Factor (GLF)

GLF ranges from 0 to 1. It is the ratio of liquidity of a multi-chain asset in a chain to the total protocol liquidity of that asset. This factor is assigned to each multi-chain asset in each chain.

For example, if the total USDC deposited across all the chains in the protocol is $50M, and out of this, $25M is in Ethereum, then the GLF of USDCEthereum is 0.5. Each chain will have an Optimal GLF decided based on different factors like total asset volume, utilization rate, total network volume, etc. If the difference is >minGLFThreshold, then a protocol partner bridge is used to transfer the asset from the chain having excess liquidity to the chain with low liquidity.

Asset Correlation Factor (ACF)

As the name suggests, this parameter calculates the correlation between the prices of two assets. For a multi-chain asset, the ACF should be ~1. However, if this factor deviates by 0.002, Cedro's investigation team will be notified and shall look into the irregularity. This process is in place to prevent the protocol from getting affected by any unfortunate event in this highly volatile space. If the deviation keeps increasing, all the operations on the particular pool will be suspended until a case-specific solution is decided by the investigation team.

Last updated